kaufman county tax assessor

P O Box 339 Kaufman TX 75142. Kaufman County Courthouse 100 W.

Your property tax bill.

. The Kaufman County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Kaufman County Texas. The minimum convenience fee for credit cards is 100. Texas has two distinct laws for designating a homestead.

Box 339 Kaufman TX 75142-0339. P O Box 339 Kaufman TX 75142. Seeing too many results.

Property Tax System Basics. Registration Renewals License Plates and Registration Stickers. 3950 S Houston St.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Property Not Previously Exempt2022 Low Income Housing Apartment Capitalization Rate. Improving and maintaining the accuracy and uniformity of appraisals of all property in Kaufman County.

Try a more simple search like just the street name. Please try again later. Monday - Friday 800 am.

The grant denial cancellation or other change in the status of an exemption or exemption application. Texas Association of Assessing Officers. 116-908-02 Quinlan Independent School District.

129-000-00 Kaufman County. For more information please visit Kaufman Countys Auditor and Treasurer or look up this propertys current tax situation here. The Real Estate Center-Data for Kaufman County.

Find results quickly by selecting the Owner Address ID or Advanced search tabs above. Address Phone Number and Fax Number for Kaufman County Assessors Office an Assessor Office at North Washington Street Kaufman TX. The median property tax on a 13000000 house is 136500 in the United States.

The eligibility of the property for exemption. The median property tax on a 13000000 house is 235300 in Texas. Appealing your property tax appraisal.

The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code for Organizations Constructing or Rehabilitating Low-Income Housing. Search could not be preformed at this time.

Box 339 Kaufman TX 75142-0339. The Texas Tax Code offers homeowners a way to apply for homestead exemptions to reduce local property taxes. Per State law taxpayers may request to receive their appraisal notices electronically in the case of one of the following circumstances.

Where do I find information on available Veterans benefits. The fee will appear as a separate charge on your credit card bill to Certified Payments. Try using the Advanced Search above and add more info to narrow the field.

The median property tax on a 13000000 house is 260000 in Kaufman County. Contact your local County Appraisal District and they will be able to assist you with any exemption qualification questions. 129-901-02 Crandall Independent School District.

Contact your local County Appraisal District and they will be able to assist you with any exemption qualification questions. Kaufman County Courthouse 100 W. Information on your propertys tax assessment.

PO Box 819 Kaufman TX 75142. 100 N Washington St. Mulberry Kaufman TX 75142.

The minimum convenience fee for credit cards is 100. To pay by telephone call 1-866-549-1010 and enter Bureau Code 5499044. Kaufman County Tax Assessor - Collector.

Except for County Approved Holidays Questions. There is a fee of 150 for all eChecks. You can contact the Kaufman County Assessor for.

The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. Apply for a Job. Use just the first or last name alone.

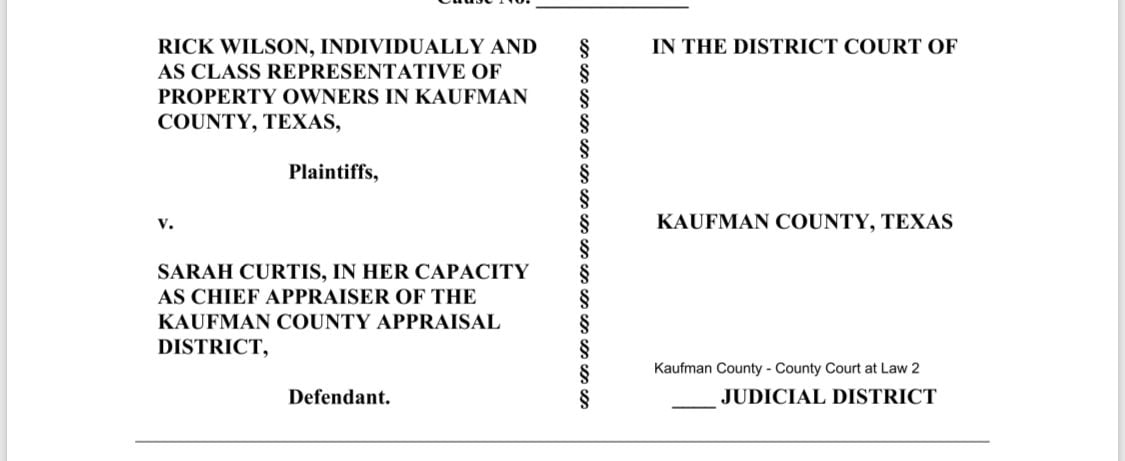

A convenience fee of 229 will be added if you pay by credit card. Chief Appraiser Sarah Curtis. Except for County Approved Holidays Questions.

Checking the Kaufman County property tax. Mulberry Kaufman TX 75142. Use UpDown Arrow keys to increase or decrease volume.

Paying your property tax. Kaufman County Assessors Office Contact Information. There is a fee of.

Vehicle Registration 469-376-4688 or Property Tax 469. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. The Texas Property Code allows homeowners to designate their homesteads to protect them from a forced sale to satisfy creditors.

Having trouble searching by Address. County tax assessor-collector offices provide most vehicle title and registration services including. How do I find my property tax balance.

A change in value of the property. Having trouble searching by Name. Kaufman County has one of the highest median property taxes in the United States and is ranked 251st of the 3143 counties in order.

Within this site you will find general information about the District and the ad-valorem property tax system in Texas as well as information regarding specific properties within the district. Texas Parks. This law does not however protect the homeowner.

M F in Kaufman Terrell and Forney. Contact information for the following CAD Districts are as follows. Brenda Samples Kaufman County Tax Assessor.

Name Kaufman County Assessors Office Address 100 North Washington Street Kaufman Texas 75142 Phone 972-932-0288 Fax 972-932-1413. Kaufman County collects on average 2 of a propertys assessed fair market value as property tax.

County Treasurer Kaufman County

Access Denied Property Records Property For Sale Office Building

Barn Style Wedding Venue In Stillwater Oklahoma Dc Builders Wedding Venues Barn Style Best Barns

Forney Mayor Files Suit Against County Appraisal District Business Inforney Com

![]()

Tax Info Kaufman Cad Official Site

Kaufman County Fresh Water Supply District 1 B

Truth In Taxation Kaufman County

County Treasurer Kaufman County

County Welcomes New Elections Administrator Kaufman County

2022 Montgomery Municipal Budget Introduced Montgomery Township New Jersey

Forms Kaufman Cad Official Site